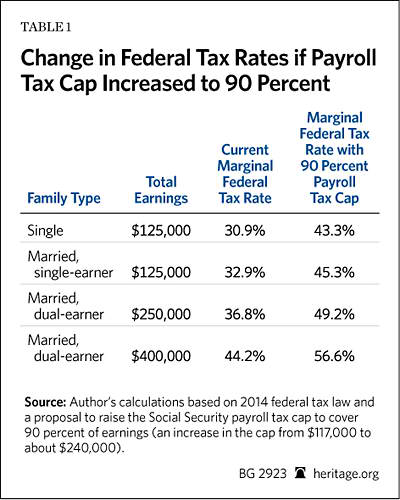

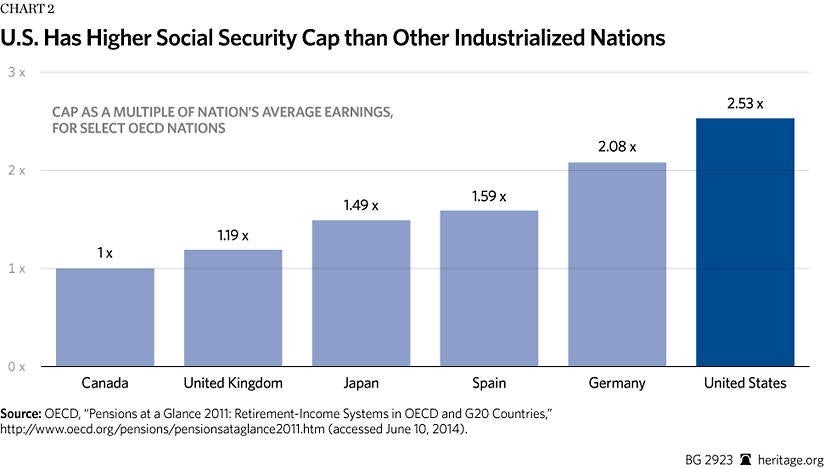

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

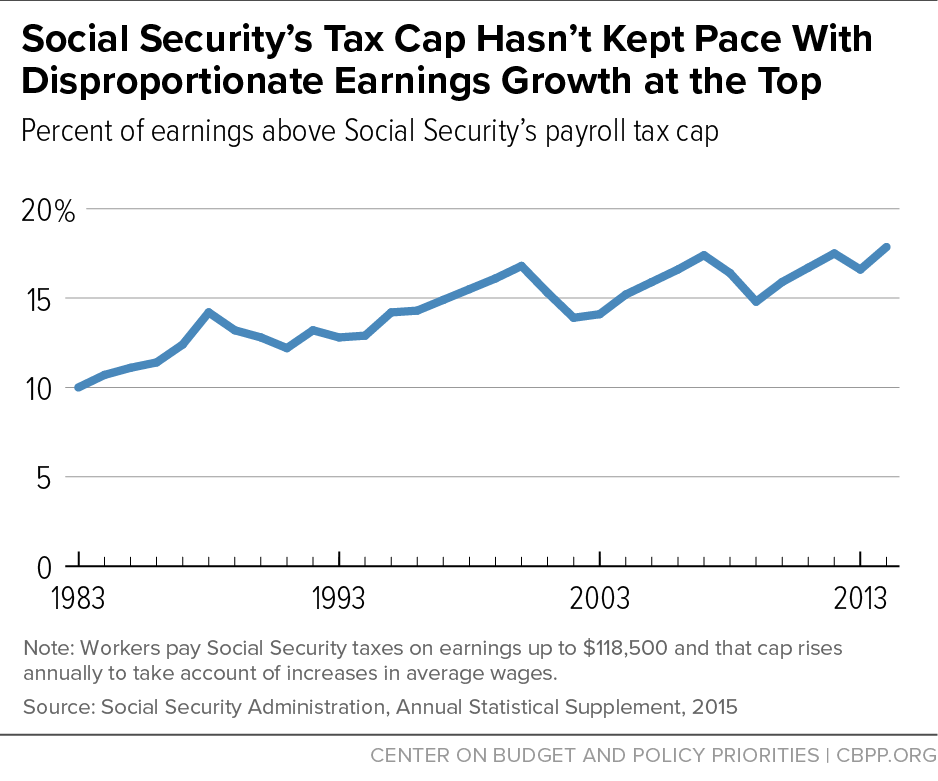

Who Would Pay More if the Social Security Payroll Tax Cap Were Raised or Scrapped? - Center for Economic and Policy Research

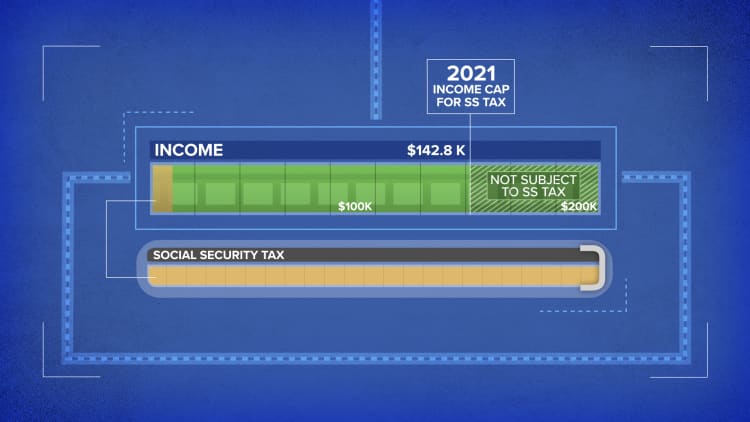

Unfair Cap Means Millionaires Stop Contributing to Social Security on February 28, 2023 - Center for Economic and Policy Research